This 3‑part blog series discusses ways to address the challenges of maintaining profits in the changing world of drug discovery in the face of increased competition, pricing pressures, and more targeted therapies (with resulting smaller patient populations).

Healthprize CEO Tom Kottler has identified 4 seemingly simple approaches that a pharma firm can take to maintain their revenue streams:

- Launch new products

- Have physicians write more scripts of existing products

- Get patients to take their medications

- Raise prices

In the first blog, I focused on #2 and wrote about the considerations made by physicians when prescribing drugs, including lifestyle and ease of use. Key takeaway: Based on patient survey data and other market research, needle‑free drug delivery could be a strong market differentiator as patients are likely to specifically request drugs delivered needle‑free and physicians are likely to prescribe.

In the 2nd blog, I focused on #3 and wrote about the impact adherence can have both clinically and financially for the patient, healthcare system, and drug company. Key takeaway: A small improvement in adherence can have a significant impact on a drug’s revenue opportunity. The first step to addressing adherence, is to start accurately measuring who is taking the drug and when. By automatically tracking injections through a connected injector like Portal’s, and then being able to address root causes and corrective actions, pharmaceutical firms have the opportunity to increase their revenue by helping the patients they have already reached.

In this blog, I will look at #4: Raise prices.

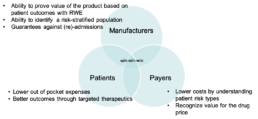

Raising prices is not really an option ‑‑ at least not as a blanket approach. Around the world, patients, payers and governments are balking at the high price of many drugs and are asking, “Will this drug work? For Whom?” and “Where is the value?”

These are common questions across the entire healthcare system, which has led to the emergence of new value‑based pricing models such as “bundled payments”, “indication‑based pricing” or “outcomes-based pricing”. In these models, drug reimbursement is tied to its clinical effectiveness and associated value. For pharmaceutical companies, this means bearing some of the risk that the drug will work in the real world.

One example of an outcomes-based agreement is between Spark Therapeutics and Harvard Pilgrim, a nonprofit health plan covering 1.2 million people. Spark will pay rebates on Luxturna, its $850,000 retinal disorder gene therapy, if a patient’s vision doesn’t meet certain criteria in 30 to 90 days and then at 30 months after treatment.1

Another outcomes based pricing example: Novartis’ $475,000 one‑time treatment Kymriah, used for a form of leukemia. There will be no charge for Kymriah if the treatment isn’t working after a month.2 Other examples can be found in this paper written by Deloitte.3

Value‑Based Contracts ‑ The Future of Pricing

The goal of lowering costs for payers and patients seems to be working: last year, the Pharmaceutical Research and Manufacturers of America reported that “commercially insured patients in health plans with value‑based contracts for diabetes, high cholesterol and HIV medicines had copays that were, on average, 28 percent lower for those medicines compared to patients in other plans.”4

Despite this success, adoption has been slow. Some of the challenges to greater adoption include clarity around government pricing; difficulties developing consensus on value metrics and price thresholds; measurement tools for the defined value, and data sharing. Ed Schoonveld, managing Principal at ZS Associatess told EyeforPharma that outcome-based contracts “require a lot of data gathering and a lot of data analysis, which can stand in the way of meaningful agreements.” 5

DATA‑DATA‑DATA

With an outcomes based approach, there is a prerequisite to deeply understand patients on a population level in order to predict who will benefit, as well as on an individual retrospective level to know who has benefited. This requires short‑term and potentially long‑term outcomes data.

However, in order for a drug to work, it has to be taken. Which brings us back to the need for greater adherence and improved visibility into adherence. In a value‑based care model, if the patient does not respond to the medication, it is not reimbursed and that patient may be added to the ‘non‑respondent’ population pool. It is therefore vital to understand if patients are truly not responding or just not adherent. Results due to lack of adherence could skew results inappropriately for both the pharma company, the payer, and future potential patients.

Connected drug‑delivery devices which automatically collect drug administration data in the home can provide the accurate, real‑time adherence information needed. There are many ways to collect adherence ‑ ask the patient, have them log it in an app, or connect their device to an app to log the dose. But these solutions ask for the patient to take an action which leads to questions regarding the data viability and accuracy. If a patient didn’t log a dose, is it because they didn’t take it or because they forgot to log it? The best way to measure adherence is to have it collected automatically, seamlessly, with no action required on the patient’s part. By knowing near real‑time when a patient is non‑adherent, the pharma firm (via hub services) can take action to improve adherence ‑ and thus increase the likelihood that the patient will have a positive clinical outcome (and pharma will be paid).

Take‑Aways:

The future of pricing in healthcare is based on value and return. This requires a new level of data that has not consistently been collected nor used before. Portal’s connected drug delivery device, which automatically and seamlessly collects adherence data and integrates into the greater healthcare record, is a key enabler to move towards a value based pharma model.

About Portal Instruments:

Portal Instruments is developing a connected, needle‑free injector for pharmaceutical partners to offer a better solution to their patients who are on injectables and looking for a modern drug delivery device to fit into their lifestyle.

1. https://www.cnbc.com/2018/01/03/spark‑therapeutics‑luxturna‑gene‑therapy‑will‑cost‑about‑850000.html

2. https://www.pharmaceutical‑technology.com/comment/outcome‑based‑contracts‑kymriah/

3. https://deloitte.wsj.com/cfo/files/2012/09/ValueBasedPricingPharma.pdf

4. https://www.phrma.org/press‑release/value‑based‑contracts‑may‑lower‑patients‑out‑of‑pocket‑costs‑by‑28‑percent

5. https://social.eyeforpharma.com/access‑and‑evidence/naked‑truth‑about‑outcomes‑based‑pricing

Portal's platform is in development and not available for sale or use.