Like many industries over the last decade, the pharmaceutical industry is seeing a major change in business models. Drugs are becoming more targeted to the specific patient which means fewer blockbuster drugs that can serve a wide population. Payers are asking for clinical results to justify high priced drugs resulting in new value-based pricing models. For biologics, the emergence of biosimilars brings the threat of increased competition (and pricing pressure). In short, for many high investment therapeutics, the pharma firm is facing a limited patient population and decreasing reimbursement.

The question is, what can a pharmaceutical firm do to sustainably grow revenue and margins?

In a simplistic view (which I am borrowing from a presentation Tom Kottler, Healthprize CEO gave at eyeforPharma Philadelphia 2018), there are 4 approaches that a pharmaceutical firm can take to make money:

- Launch new products

- Have physicians write more scripts for existing products

- Get patients to take their medications

- Raise prices

#1 – Launch new products – either by acquiring assets or doubling down on R&D. Let’s put this aside and look at what can be done for drugs already on the market.

This article will look at #2 in depth and I’ll cover #3 and #4 in a follow-up blog.

#2. Have physicians write more scripts -> Double down on sales and marketing.

The question now becomes, “How do doctors decide what to prescribe? How can this be influenced?” Based upon numerous conversations with HCPs, Portal found that they first considered the safety and efficacy of the drug for the particular patient. What is the safety profile? Are there any contra-indications or co-morbidities to be concerned about? Can the patient handle the side-effects?

The second consideration is insurance and access. Is the medication covered by insurance? Can they afford it?

And third, the patient’s lifestyle and ease of use: Will patients be able to give him or herself an injection or would they be better off going to a clinic for an IV? Can they remember to take it on time? Is this device simple enough to use for this patient? This last decision point, which often involves drug delivery, is an important consideration that is often overlooked by pharmaceutical manufacturers.

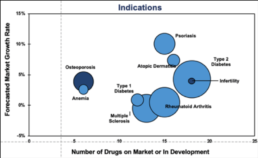

However, with the rise of competition in many indications, efficacy and safety may not be significantly different enough to prompt an HCP to change (or maintain) their prescribing patterns.1

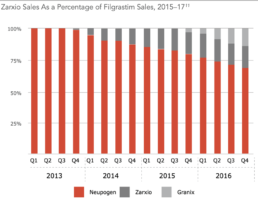

Certainly this has been the case with Neupogen and competing biosimilars Granix and Zarxio.2

Source: Back Bay Life Science Advisors, US Biosimilars 2018: Opportunities and Challenges

So how can pharmaceutical firms differentiate beyond the science?

Commercial teams talk about being patient-centered as a differentiator (which drug company doesn’t say this?). But being patient-centric can go beyond building an app, great commercials, or patient services. Drug delivery can play a huge role in meeting a patient’s lifestyle requirements and can be a significant differentiator.

Back to the earlier example of Neupogen. Though Zarxio had an impact, sales did not achieve Zarxio’s expected levels, in part, because Amgen made changes to the injector and provided ancillary services.2

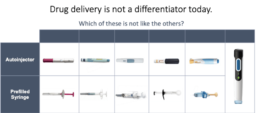

If you look at chronic disease areas that are commonly treated via subcutaneous injections, most of the drug delivery devices (pre-filled syringes or auto-injectors) look the same. While each of the devices on the market have subtle differences in nuance and features, none are different enough to stand out or cause a change in prescribing behavior.

However, something radically different, such as Portal Instrument’s electro-mechanical needle-free jet injector does.

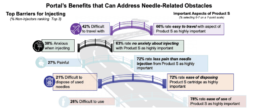

The ‘pain’ with needles It is approximated that 20-30% of adults are afraid of needles3 but the ‘pain’ of needles goes beyond the physical sensation. Portal recently commissioned Market Research Partners to ask 600 patients with multiple sclerosis, Parkinsons and moderate to severe atopic dermatitis about their challenges and preferences with injectables. Travel, anxiety, pain, disposal, and difficulty to use were all listed as concerns and barriers to injecting. When shown Portal’s needle-free injector, the lack of needle, ease of use, and disposable plastic cartridge were seen as positive attributes to address these challenges.

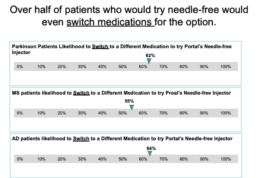

The next question we asked, would needle-free benefits be enough to cause a patient to ask for or even switch medications for a needle free option? In the study conducted by Market Research Partners, there was a strong YES to these questions. 70% of the Atopic Dermatitis and Multiple Sclerosis patients said they were involved with the decision regarding which medication to take. The majority of patients were highly likely to try Portal’s needle free injector and of those, over half would even switch medications for the needle-free option.

Take-Away & Considerations

Drug delivery makes a difference in the patient experience and by looking at what is available on the market, not used as a differentiator when it clearly could.

So back to the original strategy of “Have physicians write more scripts of existing products”, instead of more of the same of sales and marketing, I challenge pharmaceutical executives to think about offering Portal’s needle-free drug delivery option. If a company could conservatively capture 5-10% of an unserved market by getting rid of the needle and capture just 5% more through switching, how much would that improve the revenue stream?

In part II of this blog, I’ll look at the other 2 strategies to creating revenue:

3. Get patients to take their medications

4. Raise prices

About the author: Barb Taylor leads the marketing department at Portal Instruments.

1.Portal Analysis.

2.Back Bay Advisors, US Biosimilars 2018: Opportunities and Challenges. https://bblsa.com/documents/Back-Bay-US-Biosimilars-2018.pdf

3.McLenon, Jennifer and Mary AM Rogers. “The fear of needles: A systematic review and meta-analysis.” Journal of Advanced Nursing (2018).

Portal’s platform is in development and not available for sale or use.